Writing a check?

Not sure where to start?

Don’t worry, it’s not rocket science.

we will guide you in five simple steps.

Whether you’re trying to learn how to write a check for the first time or brushing up on your forgot-how, our guide will have you cashing out like an expert money-handler in no time!

So settle into that comfy spot of yours and let’s get started learning all about checks.

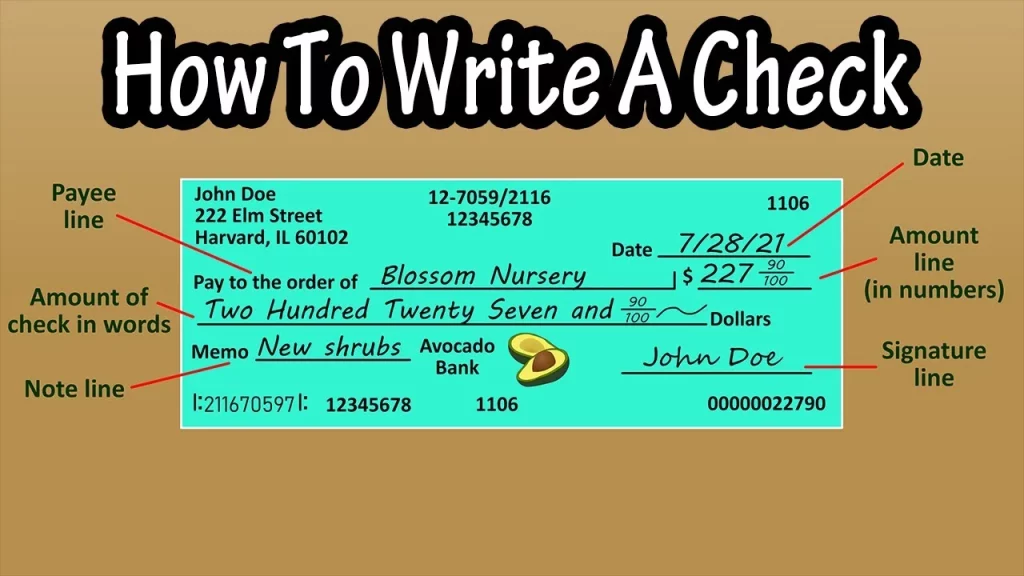

Understanding the Different Parts of a Check

It is important to understand the different parts of a check.

Here are the essential elements you need to know: The Date Line

The date line is where you write the date you are writing the check.

This date should be the same as the day you are signing the check or a future date.

Avoid writing a past date as the check will be considered invalid.

The Payee Line

The payee line is where you write the name of the person or organization you are paying.

Be sure to write the full and correct name of the payee to avoid any confusion or payment delays.

The Amount Line

The amount line on a check is crucial.

It requires you to write the amount in both numerical and written form.

Accuracy in this section is important to avoid the hassle of a returned check or an incorrect deduction from your account.

Get it right the first time to save yourself trouble later.

The Memo Line

The memo line is optional, but it can be useful to include additional information about the payment.

Make your payments more informational by adding a memo line.

Although optional, including additional details such as a reference, invoice number or brief description can prove helpful to the recipient.

How to Write a Check

Let’s learn how to write a check step-by-step

Step 1: Write the Date

Begin by writing the date on the top right corner of the check.

Be sure to write the full date, including the month, day, and year.

Step 2: Write the Payee’s Name

On the line that says “Pay to the order of,” write the full name of the person or organization you are paying.

Always spell the name correctly and write it in full alphabetic.

Step 3: Write the Amount in Numbers

On the small line on the right side of the check, write the amount of the check in numerical form.

Start at the left side and write the dollar amount, followed by a decimal point, and then the cents.

Step 4: Write the Amount in Words

On the line underneath the payee’s name, write the amount of the check in words.

Start by writing the dollar amount, followed by the word “and,” and then the cents.

Be sure to write the amount in capital letters and include the word “only” at the end.

Step 5: Fill in the Memo Line

If you want to include additional information about the payment, write it in the memo line.

This could be a reference number, an invoice number, or a brief description of the payment’s purpose.

Keep in mind that the memo line is optional and not required for the check to be valid.

Step 6: Sign the Check

Sign the check in the bottom right corner using the same name that appears on the account.

If you are writing a joint account check, make sure that all account holders sign the check.

Common Mistakes to Avoid

While writing a check is a simple process, there are a few common mistakes you should avoid: Writing a past date on the check

- Writing a check with insufficient funds

- Forgetting to sign the check

- Writing the wrong amount in words or numbers

- Spelling the payee’s name incorrectly

To avoid these mistakes, double-check all the information on the check before signing and sending it.

Tips for Writing Checks Safely and Securely

Here are some tips to help you write checks safely:

- Use a secure location to store your checkbook and blank checks

- Only write checks to people or organizations you trust

- Avoid writing checks for large amounts to people you don’t know well

- Be cautious when writing checks for online transactions

- Don’t share your personal or financial information others.

By following these tips, you can prevent fraud.

Conclusion

While writing a check may appear to be an outdated payment method, it remains a critical ability to possess.

By adhering to this comprehensive guide and avoiding typical mistakes, you can confidently write checks safely and securely.

Always double-check the information on your check and keep your personal and financial data secure for complete peace of mind.

FAQs

Can I write a check with a pencil?

No, checks must be written in ink to be valid.

Can I write a check for more than the amount in my account?

No, writing a check with insufficient funds is illegal and can result in fines or legal action.

How long do I have to cash a check?

It depends on the bank’s policy.

Can I use abbreviations when writing a check?

It is best to avoid using abbreviations to prevent confusion or mistakes.

Write out the full name or amount instead.

Do I need to include the cents when writing the amount in words?

Yes, always include the cents when writing the amount in words to prevent any confusion or mistakes.